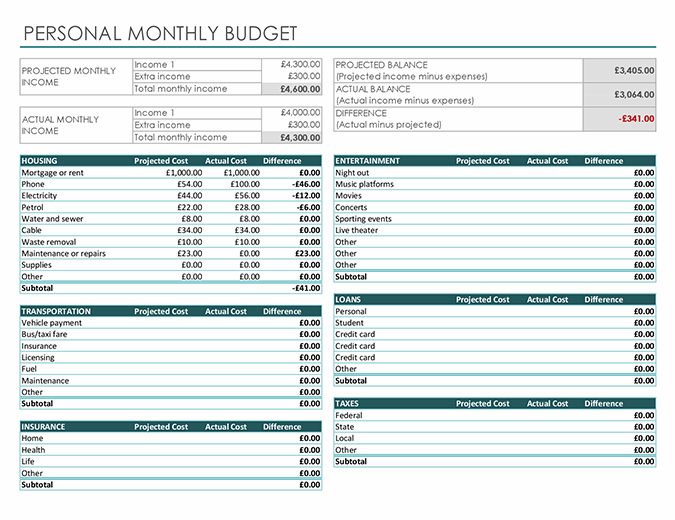

Row 49 is again formula based which shows the money left after meeting the savings target, and if it is in red, which is negative, it means that the person has not met his/her saving target in that month.First reason: it's free. Row 47 has target savings, which $3,000 in this case, but a person using the template can amend it to a savings amount of their choice. In other words, row 46, which is also formula based shows the money left in the hands of a person after incurring all the expenses. Then we have savings on row 42, which shows the difference between income and expenses. You can always add the total columns for various expense heads also. Row 44 shows the total expenses, and it is formula based. Starting row 12 to 42, we have various kind of expenses which you can modify as per your needs. You can change the type of receipt in column A and row 10 has a formula that adds up to Total receipts. In the template row, 5 to 9 has various types of Incomes and receipts. This template can be used by Individuals for tracking their day to day expenses and also by small businesses to track their expenses and receipts.

#Personal budget spreadsheet pdf how to

How to use this Personal Budget Planner Template? read more and year over year analysis, which will help in accurately tracking down the expenses and meet any sudden expenditure by accumulating the saving amount over a period of time. This chart also helps in calculation of month over month variance analysis Variance Analysis Variance analysis is the process of identifying and analyzing the difference between the standard numbers that a company expects to accomplish and the actual numbers that they achieve, in order to help the firm analyze positive or negative consequences. For example, in the month of July, the person can say that my monthly expenditure is close to $5.7K, and next time if he/she definitely wants to meet the savings target, they might have to adjust or cut down on some of the expenses. This data can be utilized to calculate the monthly expenses by taking an average. It shows that in those two months, the person has less income from business and that why he fell short of savings. If we see the April and May months data, the target saving is short by $73 & $51, respectively. This template helps in tracking monthly expenses and also shows the months where the target savings were not met.

In this case, the person earns an average of $8,892 per month, had a target savings of $3,000, and an average monthly expense is $5,681. They can also change the range to see the average of any period they want to see and analyze.

Any person using this personal budget spreadsheet template has to, only, enter the expense and income amount and adjust the formulas given in the excel template, and it will show the total and average of the income and expenses. Now, if we look at the chart, it shows the monthly expenses from Jan to June, the excel template attached here shows January to December, but for convenience, the table in word shows from January to June for six months. The chart is not exclusive, but a person can always make changes and include the multiple heads of expenses that they incur. In the above example, we see the receipts from salary and business and various types of expenses.

Source: Personal Budget Template () About the Template

#Personal budget spreadsheet pdf free

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

To understand it better let us go through the below personal budget planner template of Mr.

0 kommentar(er)

0 kommentar(er)